Insights: Tax Services

When an elderly parent might qualify as your dependent

It’s not uncommon for adult children to help support their aging parents. If you’re in this position, you might qualify for the adult-dependent exemption. It allows eligible taxpayers to deduct up to $4,050 for each adult dependent claimed on their 2016 tax return. Basic qualifications For you to qualify for the adult-dependent exemption, in most…

Read MoreWhen it comes to charitable deductions, all donations aren’t created equal

As you file your 2016 return and plan your charitable giving for 2017, it’s important to keep in mind the available deduction. It can vary significantly depending on a variety of factors. What you giveOther than the actual amount you donate, one of the biggest factors that can affect your deduction is what you give:…

Read MoreTake stock of your inventory accounting method’s impact on your tax bill

If your business involves the production, purchase or sale of merchandise, your inventory accounting method can significantly affect your tax liability. In some cases, using the last-in, first-out (LIFO) inventory accounting method, rather than first-in, first-out (FIFO), can reduce taxable income, giving cash flow a boost. Tax savings, however, aren’t the only factor to consider.…

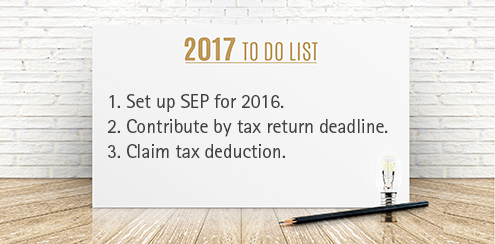

Read MoreSEPs: A powerful retroactive tax planning tool

Simplified Employee Pensions (SEPs) are sometimes regarded as the “no-brainer” first choice for high-income small-business owners who don’t currently have tax-advantaged retirement plans set up for themselves. Why? Unlike other types of retirement plans, a SEP is easy to establish and a powerful retroactive tax planning tool: The deadline for setting up a SEP is…

Read MoreDeduct all of the mileage you’re entitled to — but not more

Rather than keeping track of the actual cost of operating a vehicle, employees and self-employed taxpayers can use a standard mileage rate to compute their deduction related to using a vehicle for business. But you might also be able to deduct miles driven for other purposes, including medical, moving and charitable purposes. What are…

Read MoreIRS Reduces Standard Mileage Rates For 2017

The IRS has announced decreases in the standard mileage rates that taxpayers will use for calculating business, medical, and moving expenses in 2017. Use of the standard mileage rate is a popular alternative to using the actual expense method, which requires taxpayers to keep track of specific costs for maintenance, repairs, tires, gas, oil, insurance,…

Read More- « Previous

- 1

- …

- 34

- 35

- 36

SUBSCRIBE TO OUR NEWSLETTER

Receive timely news and updates from our newsletter.