Insights: Tax Services

Bartering may be cash-free, but it’s not tax-free

Bartering might seem like something that happened only in ancient times, but the practice is still common today. And the general definition remains the same: the exchange of goods and services without the exchange of money. Because no cash changes hands in a typical barter transaction, it’s easy to forget about taxes. But, as one…

Read MoreTax-smart options for your old retirement plan when you change jobs

There’s a lot to think about when you change jobs, and it’s easy for a 401(k) or other employer-sponsored retirement plan to get lost in the shuffle. But to keep building tax-deferred savings, it’s important to make an informed decision about your old plan. First and foremost, don’t take a lump-sum distribution from your old…

Read MoreVictims of a disaster, fire or theft may be able to claim a deduction

If you suffered damage to your home or personal property last year, you may be able to deduct these “casualty” losses on your 2016 federal income tax return. A casualty is a sudden, unexpected or unusual event, such as a natural disaster (hurricane, tornado, flood, earthquake, etc.), fire, accident, theft or vandalism. A casualty loss…

Read MoreThe Section 1031 exchange: Why it’s such a great tax planning tool

Like many business owners, you might also own highly appreciated business or investment real estate. Fortunately, there’s an effective tax planning strategy at your disposal: the Section 1031 “like kind” exchange. It can help you defer capital gains tax on appreciated property indefinitely. How it works Section 1031 of the Internal Revenue Code allows you…

Read MoreWhen an elderly parent might qualify as your dependent

It’s not uncommon for adult children to help support their aging parents. If you’re in this position, you might qualify for the adult-dependent exemption. It allows eligible taxpayers to deduct up to $4,050 for each adult dependent claimed on their 2016 tax return. Basic qualifications For you to qualify for the adult-dependent exemption, in most…

Read MoreWhen it comes to charitable deductions, all donations aren’t created equal

As you file your 2016 return and plan your charitable giving for 2017, it’s important to keep in mind the available deduction. It can vary significantly depending on a variety of factors. What you giveOther than the actual amount you donate, one of the biggest factors that can affect your deduction is what you give:…

Read MoreTake stock of your inventory accounting method’s impact on your tax bill

If your business involves the production, purchase or sale of merchandise, your inventory accounting method can significantly affect your tax liability. In some cases, using the last-in, first-out (LIFO) inventory accounting method, rather than first-in, first-out (FIFO), can reduce taxable income, giving cash flow a boost. Tax savings, however, aren’t the only factor to consider.…

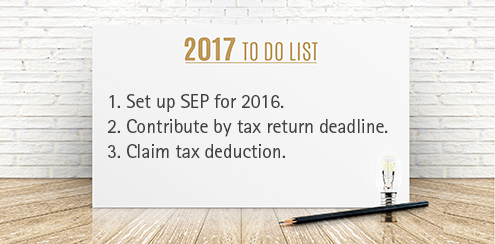

Read MoreSEPs: A powerful retroactive tax planning tool

Simplified Employee Pensions (SEPs) are sometimes regarded as the “no-brainer” first choice for high-income small-business owners who don’t currently have tax-advantaged retirement plans set up for themselves. Why? Unlike other types of retirement plans, a SEP is easy to establish and a powerful retroactive tax planning tool: The deadline for setting up a SEP is…

Read MoreDeduct all of the mileage you’re entitled to — but not more

Rather than keeping track of the actual cost of operating a vehicle, employees and self-employed taxpayers can use a standard mileage rate to compute their deduction related to using a vehicle for business. But you might also be able to deduct miles driven for other purposes, including medical, moving and charitable purposes. What are…

Read MoreIRS Reduces Standard Mileage Rates For 2017

The IRS has announced decreases in the standard mileage rates that taxpayers will use for calculating business, medical, and moving expenses in 2017. Use of the standard mileage rate is a popular alternative to using the actual expense method, which requires taxpayers to keep track of specific costs for maintenance, repairs, tires, gas, oil, insurance,…

Read More- « Previous

- 1

- …

- 33

- 34

- 35

SUBSCRIBE TO OUR NEWSLETTER

Receive timely news and updates from our newsletter.