Insights: Audit and Review Services

2023 Q3 tax calendar: Key deadlines for businesses and other employers

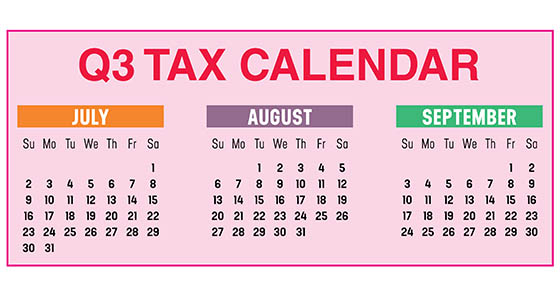

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. July…

Read MoreKeep these DOs and DON’Ts in mind when deducting business meal and vehicle expenses

If you’re claiming deductions for business meals or auto expenses, expect the IRS to closely review them. In some cases, taxpayers have incomplete documentation or try to create records months (or years) later. In doing so, they fail to meet the strict substantiation requirements set forth under tax law. Tax auditors are adept at rooting…

Read MoreVehicle expenses: Can individual taxpayers deduct them?

It’s not just businesses that can deduct vehicle-related expenses on their tax returns. Individuals also can deduct them in certain circumstances. Unfortunately, under current law, you may not be able to deduct as much as you could years ago. For years prior to 2018, miles driven for business, moving, medical and charitable purposes were potentially…

Read MoreChecking in on Your Accounts Payable Processes

Accounts payable is a critical area of concern for every business. However, as a back-office function, it doesn’t always get the attention it deserves. Once in place, accounts payable processes tend to get taken for granted. Following are some tips and best practices for improving your company’s approach. Be strategic Too often, businesses take a…

Read MoreTighten Up Billing and Collections to Mitigate Economic Uncertainties

While many economic indicators remain strong, the U.S. economy is still giving business owners plenty to think about. The nation’s gross domestic product unexpectedly contracted in the first quarter of 2022. Rising inflation is on everyone’s mind. And global supply chain issues persist, spurred on by events such as the COVID-19 lockdowns in China and…

Read MoreThere Still May Be Time to Cut Your Tax Bill With an IRA

If you’re getting ready to file your 2021 tax return, and your tax bill is more than you’d like, there might still be a way to lower it. If you’re eligible, you can make a deductible contribution to a traditional IRA right up until the April 18, 2022, filing date and benefit from the tax…

Read MoreGood financial records are the key to tax deductions and trouble-free IRS audits

If you operate a small business, or you’re starting a new one, you probably know you need to keep financial records of your income and expenses. In particular, you should carefully record your expenses in order to claim the full amount of the tax deductions to which you’re entitled. And you want to make sure…

Read MoreDo you want to go into business for yourself?

Many people who launch small businesses start as sole proprietors. Here are nine tax rules and considerations involved in operating as that entity. 1. You may qualify for the pass-through deduction. To the extent your business generates qualified business income, you are eligible to claim the 20% pass-through deduction, subject to limitations. The deduction is…

Read MoreCost management: A budget’s best friend

If your company comes up over budget year after year, you may want to consider cost management. This is a formalized, systematic review of operations and resources with the stated goal of reducing costs at every level and controlling them going forward. As part of this effort, you’ll answer questions such as: Are we operating…

Read MoreThe chances of an IRS audit are low, but business owners should be prepared

Many business owners ask: How can I avoid an IRS audit? The good news is that the odds against being audited are in your favor. In fiscal year 2018, the IRS audited approximately 0.6% of individuals. Businesses, large corporations and high-income individuals are more likely to be audited but, overall, audit rates are historically low. There’s no…

Read MoreSUBSCRIBE TO OUR NEWSLETTER

Receive timely news and updates from our newsletter.