Insights: Tax Services

Thinking about converting your home into a rental property?

In some cases, homeowners decide to move to new residences, but keep their present homes and rent them out. If you’re thinking of doing this, you’re probably aware of the financial risks and rewards. However, you also should know that renting out your home carries potential tax benefits and pitfalls. You’re generally treated as a…

Read MoreOnce You File Your Tax Return, Consider These Three Issues

The tax filing deadline for 2021 tax returns is April 18 this year. After your 2021 tax return has been successfully filed with the IRS, there may still be some issues to bear in mind. Here are three considerations: 1. You can throw some tax records away now You should hang onto tax records related…

Read MoreIt’s Almost That Time of Year Again! If You’re Not Ready, File for an Extension

The clock is ticking down to the April 18 tax filing deadline. Sometimes, it’s not possible to gather your tax information and file by the due date. If you need more time, you should file for an extension on Form 4868. An extension will give you until October 17 to file and allows you to…

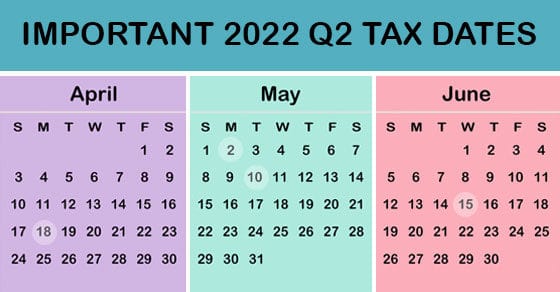

Read More2022 Q2 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing…

Read MoreEstablish a Tax-Favored Retirement Plan

If your business doesn’t already have a retirement plan, now might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example, if you’re self-employed and set up a SEP-IRA, you can contribute up to 20% of your self-employment earnings, with a maximum contribution of $61,000 for…

Read MoreThere Still May Be Time to Cut Your Tax Bill With an IRA

If you’re getting ready to file your 2021 tax return, and your tax bill is more than you’d like, there might still be a way to lower it. If you’re eligible, you can make a deductible contribution to a traditional IRA right up until the April 18, 2022, filing date and benefit from the tax…

Read MoreKeeping Meticulous Records is the Key to Tax Deductions and Painless IRS Audits

If you operate a business, or you’re starting a new one, you know you need to keep records of your income and expenses. Specifically, you should carefully record your expenses in order to claim all of the tax deductions to which you’re entitled. And you want to make sure you can defend the amounts reported…

Read MoreHow will revised tax limits affect your 2022 taxes?

While Congress didn’t pass the Build Back Better Act in 2021, there are still tax changes that may affect your tax situation for this year. That’s because some tax figures are adjusted annually for inflation. If you’re like most people, you’re probably more concerned about your 2021 tax bill right now than you are about…

Read MoreBusinesses with employees who receive tips may be eligible for a tax credit

If you’re an employer with a business where tipping is customary for providing food and beverages, you may qualify for a federal tax credit involving the Social Security and Medicare (FICA) taxes that you pay on your employees’ tip income. Basics of the credit The FICA credit applies with respect to tips that your employees…

Read More2022 Q1 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. January…

Read MoreSUBSCRIBE TO OUR NEWSLETTER

Receive timely news and updates from our newsletter.