Insights: Client Accounting Services

Is your business underusing its accounting software?

Someone might have once told you that human beings use only 10% of our brains. The implication is that we have vast, untapped stores of cerebral power waiting to be discovered. In truth, this is a myth widely debunked by neurologists. What you may be underusing, as a business owner, is your accounting software. Much…

Read More5 ways to take action on accounts receivable

No matter the size or shape of a business, one really can’t overstate the importance of sound accounts receivable policies and procedures. Without a strong and steady inflow of cash, even the most wildly successful company will likely stumble and could even collapse. If your collections aren’t as efficient as you’d like, consider these five…

Read MoreGetting a new business off the ground: How start-up expenses are handled on your tax return

Despite the COVID-19 pandemic, government officials are seeing a large increase in the number of new businesses being launched. From June 2020 through June 2021, the U.S. Census Bureau reports that business applications are up 18.6%. The Bureau measures this by the number of businesses applying for an Employer Identification Number. Entrepreneurs often don’t know…

Read More2021 Q3 Tax Calendar

2021 Q3 tax calendar: Key deadlines for businesses and other employers Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all…

Read MoreClaiming the Employee Retention Tax Credit

The Employee Retention Tax Credit (ERTC) is a valuable tax break that was extended and modified by the American Rescue Plan Act (ARPA), enacted in March of 2021. Here’s a rundown of the rules. Background Back in March of 2020, Congress originally enacted the Employee Retention Tax Credit in the CARES Act to encourage employers…

Read MoreWhen does a hobby become taxable?

Do you have a hobby that pays the bills? During the uncertainty of the last year and a half, many people have turned a hobby into a source of income. If so, that income must be reported on tax returns. Deductions & Reporting The extent to which you can deduct expenses related to the activity…

Read MoreEmployee Retention Credit Summary

2020 Highlights: An employer becomes eligible if they: can demonstrate a 50% or more decline in gross receipts in any quarter of 2020, compared to the same quarter in 2019 eligibility ends the last day of the first subsequent quarter when gross receipts return to at least 80% compared to the same quarter in 2019…

Read MoreFarm Use Valuation

The reporting period for Farm Use Valuation is open from July 1, 2021, until September 1, 2021. Each year the reporting period runs July 1st through September 1st. You may file this report electronically or as a paper copy. You might receive a pre-printed copy from your County Assessors’ office if you filed in 2020.…

Read MoreLook at your employee handbook with fresh eyes

For businesses, so much has changed over the past year or so. The COVID-19 pandemic hit suddenly and companies were forced to react quickly — sending many employees home to work remotely and making myriad other tweaks and revisions to their processes. Understandably, you may not have fully documented all the changes you’ve made. But…

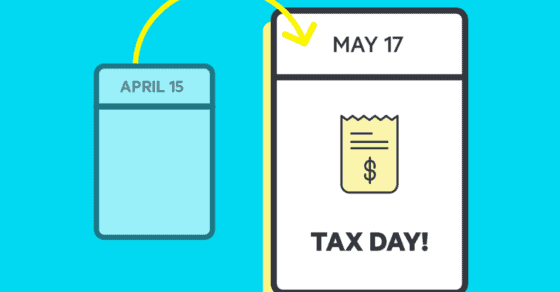

Read MoreThe 2020 tax filing deadline is coming up: Do you need an extension?

“Tax day” is just around the corner. This year, the deadline for filing 2020 individual tax returns is Monday, May 17, 2021. The IRS postponed the usual April 15 due date due to the COVID-19 pandemic. If you still aren’t ready to file your return, you should request a 2020 tax filing extension. Anyone can…

Read MoreSUBSCRIBE TO OUR NEWSLETTER

Receive timely news and updates from our newsletter.