Insights: Client Accounting Services

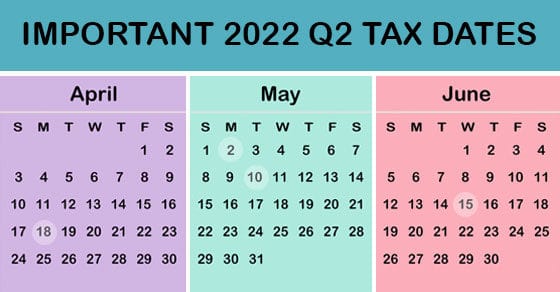

2022 Q2 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing…

Read MoreEstablish a Tax-Favored Retirement Plan

If your business doesn’t already have a retirement plan, now might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example, if you’re self-employed and set up a SEP-IRA, you can contribute up to 20% of your self-employment earnings, with a maximum contribution of $61,000 for…

Read MoreThere Still May Be Time to Cut Your Tax Bill With an IRA

If you’re getting ready to file your 2021 tax return, and your tax bill is more than you’d like, there might still be a way to lower it. If you’re eligible, you can make a deductible contribution to a traditional IRA right up until the April 18, 2022, filing date and benefit from the tax…

Read MoreKeeping Meticulous Records is the Key to Tax Deductions and Painless IRS Audits

If you operate a business, or you’re starting a new one, you know you need to keep records of your income and expenses. Specifically, you should carefully record your expenses in order to claim all of the tax deductions to which you’re entitled. And you want to make sure you can defend the amounts reported…

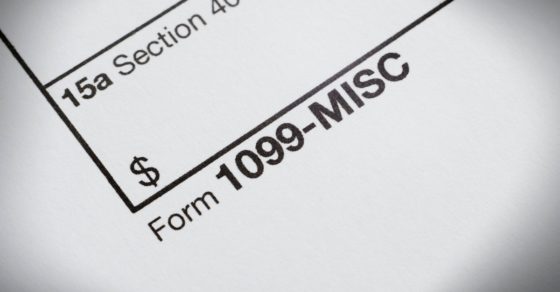

Read MoreImportant Information on 1099s!

1099s are misunderstood and underemphasized. Businesses are required to issue a Form 1099 to each third party to whom they have paid at least $600 in rents, services, prizes and awards, or other income payments. Form 1099-NEC was first introduced for the year 2020 year, and is only used to report nonemployee compensation (NEC). Form…

Read MoreIt’s W-2 time…not so fast!

W-2s serve the important function of giving an employee a record of their taxable earnings, as well as the federal and state taxes that were withheld by their employer on their behalf. W-2 forms are familiar to most people and are a well-known part of payroll and an individual’s Form 1040 tax preparation. Many believe…

Read MoreSmall businesses: There still may be time to cut your 2021 taxes

Don’t let the holiday rush keep you from considering some important steps to reduce your 2021 tax liability. You still have time to execute a few strategies. Purchase assets Thinking about buying new or used equipment, machinery or office equipment in the new year? Buy them and place them in service by December 31, and…

Read MoreWould you like to establish a Health Savings Account for your small business?

With the increasing cost of employee health care benefits, your business may be interested in providing some of these benefits through an employer-sponsored Health Savings Account (HSA). For eligible individuals, an HSA offers a tax-advantaged way to set aside funds (or have their employers do so) to meet future medical needs. Here are the important…

Read More4 red flags of an unreliable budget

Every business should prepare an annual budget. Creating a comprehensive, realistic spending plan allows you to identify potential shortages of cash, possible constraints on your capacity to fulfill strategic objectives, and other threats. Whether you’ve already put together a 2022 budget or still need to get on that before year-end, here are four red flags…

Read MoreHR News You Can Use: Covid-19 Sick Leave

With the recent surge in COVID-19 cases, employers should refamiliarize themselves with the Emergency Paid Sick Leave benefits as extended in The American Rescue Plan Act originally passed in March 2021. While this program is VOLUNTARY for employers, credit is still allowed against applicable employer payroll taxes equal to 100 percent of the qualified sick…

Read MoreSUBSCRIBE TO OUR NEWSLETTER

Receive timely news and updates from our newsletter.